Today's Market

by Dr Invest

by Dr Invest

We pray for those on the East Coast who will undergo Hurricane Sandy. I know that many lives will be traumatized and real losses will hurt those who are already hurting economically. So may God protect our friends on the East Coast.

Gary Shiller with Bloomberg wrote an article today from which I want to give you a few quotes. You can go to the article yourself and read it in its entirety at: http://www.bloomberg.com/news/2012-10-28/bargain-addicted-investors-ignore-perils-of-low-rates.html

Gary has come to a conclusion that I have already been expressing from this blog. So let's look at some of the key ideas:

The U.K. and the euro zone are in a recession, the U.S. economy is teetering, and a hard landing is unfolding in China. Softness in these three paramount economies is dragging down the rest of the world. So why do most investors seem totally unconcerned over the unfolding global contraction?

This is what I call the Grand Disconnect between weak and weakening economies worldwide, on one hand, and optimistic investors, on the other, who are hooked on massive monetary and fiscal stimulus programs.

Economies and financial markets have become so dependent on monetary and fiscal bailouts -- and investors so enamored of them -- that all seem to have forgotten the dire circumstances that continue to make these rescues necessary. Many market participants yearn for conditions that are so troubled that central banks and governments, be it in China, the U.S. orEurope, will be spurred to greater easing, with positive implications for stocks.

“Conditions are so bad that it’s good for my equity portfolio,” the thinking seems to be. This almost total reliance on monetary and fiscal stimulus, with little regard for fundamental economic performance --except to hope that growth will be weak enough to spur more government action -- is a new phenomenon. Until quite recently, there was strong faith in government action, but it was coupled with the belief that such measures would quickly re-establish robust economic growth.

Restoring Growth

I have often been asked what monetary or fiscal actions would rapidly restore economic growth, as if a magic bullet would bring back the salad days of the 1980s and 1990s. My reply was that no such cure existed. The immense monetary and fiscal stimulus in the U.S., including the $1 trillion-plus annual federal-government deficits, the $2.3 trillion in quantitative easing and about $1.5 trillion of excess bank reserves held by the Federal Reserve, probably made the economy and financial markets better off. Nevertheless, slow and now faltering global economic growth indicate that these huge efforts were more than offset by gigantic deleveraging in the private sector. The only thing that would restore normal global growth, I argued, was time -- the five to seven years it will take for deleveraging to be completed.

The search for a magic bullet seems to have been abandoned. The emphasis is now almost solely on the opiate of government stimulus, increasing quantities of which will probably be needed to keep investment addicts satisfied. The recent announcements of quantitative easing by the Fed and the European Central Bank have had a diminishing impact on the Standard and Poor’s 500 Index. And recent market actions suggest that QE3 may be a classic case of buy the rumor, sell the news.

What more can be done? The Fed’s commitment to purchase $40 billion in mortgage-backed securities a month is open-ended, and is scheduled to last until the unemployment rate, now at 7.8 percent, drops to the Fed target range of about 5 percent to 6 percent and there is robust job creation. That will probably take a number of years. Meanwhile, excess bank reserves will continue to increase.

So why did Fed Chairman Ben Bernanke push through the third round of quantitative easing? Sure, the Fed has a dual mandate to promote full employment as well as price stability, but QE3 on top of Operation Twist, QE2 and QE1 and all the Wall Street rescue measures the Fed took in 2008 have pushed the central bank deep into the realm of fiscal policy, compromising its fiercely defended independence. Also, the open-ended and unprecedented nature of QE3 might suggest that Bernanke has lost control.

Furthermore, the effectiveness of previous rounds of quantitative easing is questionable. Even though the Fed has bought $2.3 trillion of long-term securities, economic growth is marginal at best and unemployment remains very high. Of course, we will never know what would have happened had the Fed not acted. History isn’t a controlled experiment where you can change one baffle in the maze, run the rats through again and see if they take a different path.

I think I have provided enough of the article to affirm my own position. We are in a new era of investment that has never existed before. We buy stocks by faith, expecting that the FED will provide enough stimulus to keep our stocks growing 12% per year. History proves that partnerships between the government and private enterprise ends poorly.

ENTERING A STOCK POSITION

With all the above bad news, it makes one want to find their own corner for a fetal position and thumb sucking. We really don't have time for that luxury right now because now is a key time to buy stocks if we are to see any gains at all for 2012.

Here are the rules:

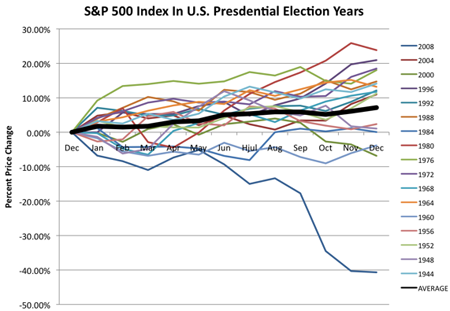

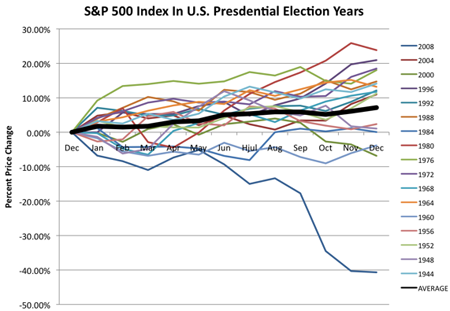

Below is a seasonal chart for ELECTION YEARS from 1944 until 2008. Six of those years fell below the average shown with the BLACK LINE. Eleven of those years rose above the average return for the S&P. So about 35% of the time the S&P fell below average and even then only 17% of the election years the S&P fell below zero. I am not going to go into deep detail here, but generally speaking you have a 64% chance for a gain, a 82% of not loosing anything, 17% chance of a loss.

There are so many factors that impact the market, that we can't just use one. The stimulus program does impact the outcome of these charts and when you consider that much of what you see in the market is artificial, it give one pause before entering a stock position.

MY FAVORITE THINGS

Let me be explicit. We are still in an economic crisis. Dollar Stores have performed well during the economic downturn and they continue to do so. See Bloomberg article: http://www.bloomberg.com/news/2012-10-26/dollarama-outperforms-wal-mart-as-retail-stock-corporate-canada.html

So here are some of my favorite things to look at for short-term seasonal gains:

STOCK YTD PERFORMANCE

DOL.TO 41.53% Dollarama (Canada)

DG 15.94% Dollar General

FDO 14.27% Family Dollar

DLTR -3.31% (about debt & expansion but longterm buying opportunity)

Dollar Tree

WMT 24.50% Walmart

TGT 25.04% Target

PETM 31.33% Pet Smart

Most of these stocks are based on consumer spending. I expect that consumer spending will be up this Christmas Season driving returns for some of these stocks even higher. All stocks will have stop-sells to avoid losses. Should the stop-sell be engaged, I won't even look back. The stock will have to prove that it can sustain profits before I will repurchase the stock.

OUR ETF STOCK POSITIONS

by Dr Invest

by Dr InvestWe pray for those on the East Coast who will undergo Hurricane Sandy. I know that many lives will be traumatized and real losses will hurt those who are already hurting economically. So may God protect our friends on the East Coast.

Gary Shiller with Bloomberg wrote an article today from which I want to give you a few quotes. You can go to the article yourself and read it in its entirety at: http://www.bloomberg.com/news/2012-10-28/bargain-addicted-investors-ignore-perils-of-low-rates.html

Gary has come to a conclusion that I have already been expressing from this blog. So let's look at some of the key ideas:

The U.K. and the euro zone are in a recession, the U.S. economy is teetering, and a hard landing is unfolding in China. Softness in these three paramount economies is dragging down the rest of the world. So why do most investors seem totally unconcerned over the unfolding global contraction?

This is what I call the Grand Disconnect between weak and weakening economies worldwide, on one hand, and optimistic investors, on the other, who are hooked on massive monetary and fiscal stimulus programs.

Economies and financial markets have become so dependent on monetary and fiscal bailouts -- and investors so enamored of them -- that all seem to have forgotten the dire circumstances that continue to make these rescues necessary. Many market participants yearn for conditions that are so troubled that central banks and governments, be it in China, the U.S. orEurope, will be spurred to greater easing, with positive implications for stocks.

“Conditions are so bad that it’s good for my equity portfolio,” the thinking seems to be. This almost total reliance on monetary and fiscal stimulus, with little regard for fundamental economic performance --except to hope that growth will be weak enough to spur more government action -- is a new phenomenon. Until quite recently, there was strong faith in government action, but it was coupled with the belief that such measures would quickly re-establish robust economic growth.

Restoring Growth

I have often been asked what monetary or fiscal actions would rapidly restore economic growth, as if a magic bullet would bring back the salad days of the 1980s and 1990s. My reply was that no such cure existed. The immense monetary and fiscal stimulus in the U.S., including the $1 trillion-plus annual federal-government deficits, the $2.3 trillion in quantitative easing and about $1.5 trillion of excess bank reserves held by the Federal Reserve, probably made the economy and financial markets better off. Nevertheless, slow and now faltering global economic growth indicate that these huge efforts were more than offset by gigantic deleveraging in the private sector. The only thing that would restore normal global growth, I argued, was time -- the five to seven years it will take for deleveraging to be completed.

The search for a magic bullet seems to have been abandoned. The emphasis is now almost solely on the opiate of government stimulus, increasing quantities of which will probably be needed to keep investment addicts satisfied. The recent announcements of quantitative easing by the Fed and the European Central Bank have had a diminishing impact on the Standard and Poor’s 500 Index. And recent market actions suggest that QE3 may be a classic case of buy the rumor, sell the news.

What more can be done? The Fed’s commitment to purchase $40 billion in mortgage-backed securities a month is open-ended, and is scheduled to last until the unemployment rate, now at 7.8 percent, drops to the Fed target range of about 5 percent to 6 percent and there is robust job creation. That will probably take a number of years. Meanwhile, excess bank reserves will continue to increase.

So why did Fed Chairman Ben Bernanke push through the third round of quantitative easing? Sure, the Fed has a dual mandate to promote full employment as well as price stability, but QE3 on top of Operation Twist, QE2 and QE1 and all the Wall Street rescue measures the Fed took in 2008 have pushed the central bank deep into the realm of fiscal policy, compromising its fiercely defended independence. Also, the open-ended and unprecedented nature of QE3 might suggest that Bernanke has lost control.

Furthermore, the effectiveness of previous rounds of quantitative easing is questionable. Even though the Fed has bought $2.3 trillion of long-term securities, economic growth is marginal at best and unemployment remains very high. Of course, we will never know what would have happened had the Fed not acted. History isn’t a controlled experiment where you can change one baffle in the maze, run the rats through again and see if they take a different path.

I think I have provided enough of the article to affirm my own position. We are in a new era of investment that has never existed before. We buy stocks by faith, expecting that the FED will provide enough stimulus to keep our stocks growing 12% per year. History proves that partnerships between the government and private enterprise ends poorly.

ENTERING A STOCK POSITION

With all the above bad news, it makes one want to find their own corner for a fetal position and thumb sucking. We really don't have time for that luxury right now because now is a key time to buy stocks if we are to see any gains at all for 2012.

Here are the rules:

- Rule one, never loose money.

- Rule two, remember rule one.

- But to enter a position (buy stocks) is risky, so determine how much you are willing to lose.

- Set a stop-sell on the amount you are willing to loose on each stock.

- Move your stop-sell behind the daily closing price if the price of the stock is going up.

Below is a seasonal chart for ELECTION YEARS from 1944 until 2008. Six of those years fell below the average shown with the BLACK LINE. Eleven of those years rose above the average return for the S&P. So about 35% of the time the S&P fell below average and even then only 17% of the election years the S&P fell below zero. I am not going to go into deep detail here, but generally speaking you have a 64% chance for a gain, a 82% of not loosing anything, 17% chance of a loss.

There are so many factors that impact the market, that we can't just use one. The stimulus program does impact the outcome of these charts and when you consider that much of what you see in the market is artificial, it give one pause before entering a stock position.

MY FAVORITE THINGS

Let me be explicit. We are still in an economic crisis. Dollar Stores have performed well during the economic downturn and they continue to do so. See Bloomberg article: http://www.bloomberg.com/news/2012-10-26/dollarama-outperforms-wal-mart-as-retail-stock-corporate-canada.html

So here are some of my favorite things to look at for short-term seasonal gains:

STOCK YTD PERFORMANCE

DOL.TO 41.53% Dollarama (Canada)

DG 15.94% Dollar General

FDO 14.27% Family Dollar

DLTR -3.31% (about debt & expansion but longterm buying opportunity)

Dollar Tree

WMT 24.50% Walmart

TGT 25.04% Target

PETM 31.33% Pet Smart

Most of these stocks are based on consumer spending. I expect that consumer spending will be up this Christmas Season driving returns for some of these stocks even higher. All stocks will have stop-sells to avoid losses. Should the stop-sell be engaged, I won't even look back. The stock will have to prove that it can sustain profits before I will repurchase the stock.

OUR ETF STOCK POSITIONS

In theory our Ivy Portfolio calls for an investment into the overall stock index for the U.S. if the SMA falls below the closing price. An exceptions to this rule is:

- If the market is in a down trend

So look at my chart below for the VTI ETF. Since mid-September VTI has been in a down trend dropping from $75.50 to now at $72.28.

I am reluctant to enter a postion in VTI as long as it stays in a down trend.

Note: the above information is for entertainment purposes only and not to be used as investment advice.