Today's Market

Dramatic rises and falls have marked the first part of 2014. Some traders love it, but for the average investor this kind of volatility is disheartening. I have not been making stock investments since 2013. I understand that I missed out on one of the best years ever in 2013, but in my estimation there exists a potential for a dramatic downturn without a corresponding upturn, a recession.

With a bull market continuing for over 5 years now, the laws of averages are not in my favor. Oh, yes, people will rush into securities, only to get smacked in the next few months by mean market taking 40+% of their gains. Both in 2000 and in 2008, the declines in the market neared 50% and I have no reason to believe that future downturns will not result in a similar decline.

You may say, "yeah, but I gained 15% last year!". When you loose 50% of the value of your stock, you have to make 100% to regain the value of your original investment. All thing considered, those who "stayed the course" have seen only a 15% rise over the past 5 years. Now if divide 15% by 5 years you get 3% per year in returns. Not quite that spectacular return of 115% touted by those wanting you to get back into the market.

I sold my stocks in April of 2007, and re-entered in 2009, then stopped my stock investments at the end of 2012. My outcome is very different, because I didn't lose 48% of the value of you stocks in 2008 and I had some reasonable gains in my reinvestment.

Many have said that 2014 will be an incredible year for investment. And I agree with that assessment, only that it will be an incredibly bad year. I would exercise caution in 2014 and 2015. I don't see how the economy will suddenly change, becoming an economic powerhouse. First, all the data suggests a tepid economy, and second, the demographics of an aging population lends itself to a declining workforce and less consumption. None of these things are supportive of a booming economy.

What you will learn, is that there is a difference between a booming stock market and a booming economy. The Fed can bolster the stock market... only for a short time, but the economy will eventually win. Debt and continued spending will result in economic bankruptcy. Businesscycle.com and the ERCI can help you visualize the current economic condition. Also Hussmanfunds.com, under weekly reports, will provide you with important current information. Look in the sidebar for RESEARCH and REPORTS.

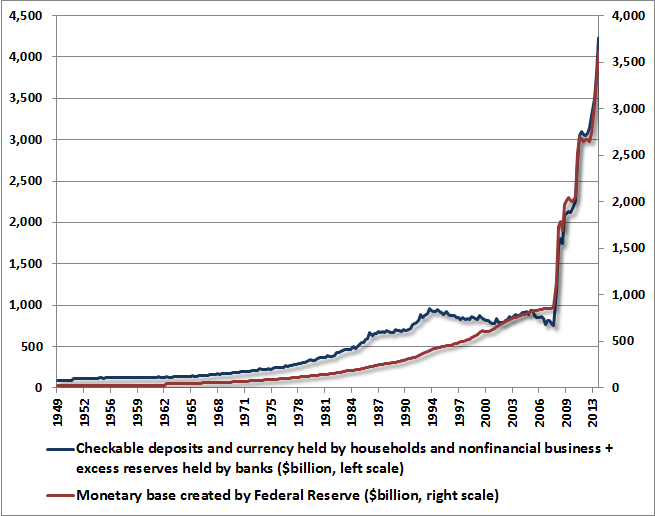

Hussman, suggests that monetary reserves, created by the FED has to be held by someone. So liquidity, injected into the market, has to be absorbed. When you buy bonds or treasuries, you are buying the bloat. (the money injected into the market)

ECRI is demonstrating by the above chart, that rather than a robust world economy, we have depressed growth. Note 2008-2009 In 2012, began a recession. Efforts by the FED brought a small reflex from the market, but growth never really returned above the baseline. We could say that growth continues to trend downward. There isn't a strong likelihood that our economy will become ROBUST.

Even though the overall returns in stocks trended upward, the overall trend of growth has been downward. Companies have reported increased inventory... that means that products are not selling. Overall, people have less consumable income. Increase in TAXES, FEES, and HEALTH CARE can be thanked. And then employers, attempting to cut costs to remain profitable, have moved employees to 30 hour weeks as PART-TIME. That means many employees have seen decreases in their incomes. Finally, many of the unemployed, just haven't returned back to work.

Stocks remain over valued, people remain under employed, and both state and federal governments continue to spend more and tax more; none of which suggest a robust economy.

(the above information is for entertainment purposes only and not to be used as financial advice.)