Today's Market

by Dr Invest

Of course I'm not investing! I know I sound like a broken record, but everyone knows that this market has not performed on its own since May of 2012. Bernanke began buying bonds driving the price of bonds down to an almost a zero interest rate. But this action, which is simply money printing, drove the price of stocks up. There was an appearance of growing wealth at the expense of bond holders, but this over valuation of stocks has drive the PE ratio into the extraordinary.

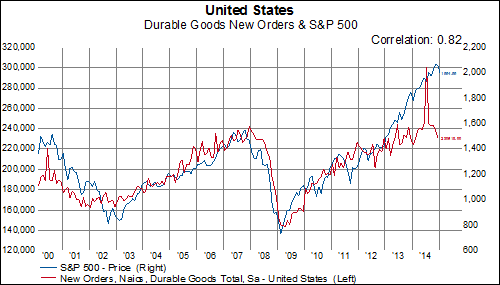

I provide the example of COPPER. Copper has moved with the S&P and is an indicator of market strength. But since May of 2012, the price of copper has dropped, while the S&P has climbed. See graph below:

by Dr Invest

Of course I'm not investing! I know I sound like a broken record, but everyone knows that this market has not performed on its own since May of 2012. Bernanke began buying bonds driving the price of bonds down to an almost a zero interest rate. But this action, which is simply money printing, drove the price of stocks up. There was an appearance of growing wealth at the expense of bond holders, but this over valuation of stocks has drive the PE ratio into the extraordinary.

I provide the example of COPPER. Copper has moved with the S&P and is an indicator of market strength. But since May of 2012, the price of copper has dropped, while the S&P has climbed. See graph below:

This would have been an indicator to SELL stocks. In the fall of 2012, copper and the S&P linked back up, appearing that there could be some market strength. But by January of 2013, copper had once again decoupled, falling to new lows while the S&P climbed to new highs.

This is what we call DEFLATIONARY ACTION. Stocks climbed, but GOLD FELL.... Stocks climbed, but OIL FELL..... Deflation is a recession, but our government has printed so much money, calling it GROWTH, that even wall street has begun to believe their own lie.

In Alex Rosenberg's article, titled Shiller is Back and has more Depressing News, he writes:

Nobel Prize-winning economist Robert Shiller has a grim message for investors: Save up, because in the years ahead, assets aren't going to give you the type of returns that you've become accustomed to. In his third edition of "Irrational Exuberance," which will drop later this month, the Yale professor of economics warns about high prices for stocks and bonds alike. "Don't use your usual assumptions about returns going forward." Shiller recommended to investors in a Thursday interview on CNBC's " Futures Now ." He says that stock valuations look rich. In fact, Shiller's favorite valuation measure, the cyclically adjusted price-earnings ratio (which compares current prices to the prior 10 years' worth of earnings) is "higher than ever before except for the times around 1929, 2000, and 2008, all major market peaks," he writes in his new preface to the third edition. "It's very hard to predict turning points in markets," Shiller said on Thursday. His CAPE measure of the S&P 500 (CME:Index and Options Market: .INX) "could keep going up. ... But it's definitely high. By historical standards, it's up there." Meanwhile, Shiller said that bond yields, which move inversely to prices, "can't keep trending down" and "could [reach] a major turning point in coming years." It's no surprise, then, that Shiller expects little in the way of asset returns-meaning Americans will have to rely more heavily on the piggy bank.

Read More Shiller warns bond investors: Beware of 'crash'! Given the current state of the stock and bond markets, "you might want to save more. A lot of people aren't saving enough. And incidentally, people are living longer now and health care is improving, you might end up retired for 30 years-people are not really preparing for that," he said. The other pillar of his advice is a classic tenant of responsible investing, with a global twist. "Diversify, because that helps reduce risk," Shiller said. "And you can diversify outside the United States. Some people would never invest in Europe-I think that's a mistake." Shiller adds that emerging markets can also provide attractive values. And indeed, valuations in much of the world are far lower than in the United States, given that investors are more optimistic about economic prospects in America than in nearly any other country. But perhaps people shouldn't base their investing decisions quite so heavily on predictions. "The future is always coming up with surprises for us, and the best way to insulate yourself from these surprises is to diversify," Shiller said.

Shiller is definitely not a 'PERMA BEAR', he is though, a BULL all the WAY. That is what has me worried, Shiller is warning all the other BULLS that this run can't last much longer. Stock are over valued like in 1929... (does that year mean anything to you?) and like 2000 and 2008....

Shiller believes that this bull run can't continue much longer. And the worry is that we could fall into even a more severe recession than in 2008. I do believe that market manipulation by the central banks will push economies into debt and default, including the U.S.

THE ANSWER FOR YOU

Yes, I know, what can you do to avoid this on-coming collapse. When the market falls, it will fall fast. Called a FLASH CRASH, wall street already has technology in place to keep people from selling their positions to get out too quickly. So the first out, will be the ones who keep their gains. The major trading firms make those decisions and place trades within GIGASECONDS. Faster than you can blink an eye, they have already make their move. You can't compete with this kind of trading.

So you need to consider when you have enough gains, to move into a cash position. Listen, a bull market cannot last forever. We are well overdue for a MAJOR MARKET CORRECTION. To keep your profits, you have to move to a cash position. Typical losses in these corrections range from 43 to 58 percent. You can loose HALF your nest egg. In a month you can see a $500,000 reduced to $250,000. To regain your loss, your investment will need to grow 100%.

So move out of STOCKS, and seek investments that are less volatile. Real Estate can be a very safe investment. Still, you will need to determine whether your area is in an economic decline before making that kind of investment.

Gold has already been mentioned, as China and Russia are buying plenty of gold because it cannot be devalued by money printing. The more money the government prints, the more expensive gold becomes. Gold is just a commodity, just metal. But it hasn't lost its glitter and continues to be the only real standard of value. I don't see that changing in the decades ahead.

In short, there are no real protections for a market that not a FREE MARKET and is manipulated by central banks. The value of Money, say the central banks, is what we say its is. They will learn the hard way that people will create their own currency, like bitcoin. Other experiments are with gold certificates, backed by real gold. The government hates these kind of competitors, because as the dollar becomes stronger against other currencies, it is actually growing weaker against the value of gold.

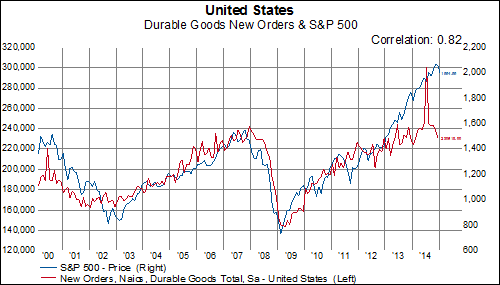

Finally, look at the chart below:

Just like COPPER, there has been a decoupling of DURABLE GOODS ORDERS from the S&P 500. And look where that decoupling occurs.... Yes, May of 2012. These charts are telling us something. The economy is not nearly as strong as our government is saying it is. Wall Street has joined right in with the government, crowing about how we are ready to have the greatest year ever. Yet the FUNDAMENTALS are telling us something very different and have been doing so since 2012. Excepting a brief SPIKE in 2014, new orders of durable goods has almost flat lined.

Even the decrease of unemployment is discouraging in that most jobs are part time and there are no significant increases in income paid to workers. This is indicative of economic weakness, not economic strength.

(Note:the above information is not to be used in any way as investment advice and is for entertainment purposes only.)