by Dr Invest

Sunday evening, I began to pour over investment opportunities after the dramatic increase in consumer spending over Black Friday. I'm already invested in WMT (Walmart), but there is a great ETF that gives me some diversity called, RTH. Market Vector's Retail holds a number of great consumer stores like Target, Home Depot, Walmart, Amazon, CVS, Lowe's, Walgreen's, Costco, TXJ compaines, and Mc Kesson Corp to name a few. Following RTH in a downtrend for several days, I placed a STOP-BUY on RTH set at $44.45. Eventhough RTH fell today .22%, my position still remains positive. At this time, we have 2/3s of our stock position purchased.

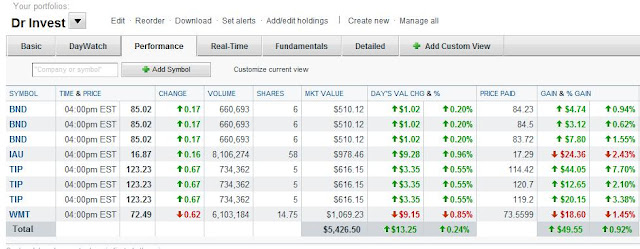

For those uninitiated to this blog, I am using $10,000 as an experimental portfolio. In May, I moved 1/3 of my $10,000 portfolio into BONDS, buying equal shares of TIP and BND with $3,333. In August I purchased $1,111 of IAU, a gold trust, for my CASH position. In mid-November, I was seeking a STOCK position and made a $1,111 purchase of WMT (Walmart) which fell 5% and tripped by STOP-SELL. Convinced that WMT (Walmart) would regain its position, I placed a STOP-BUY on WMT, following the falling price of WMT with a BUYING STOP. (This means that if the price stops falling and begins to climb, WMT would be re-bought.) Walmart did climb and was purchased with the STOP-BUY at $70.00 a share. WMT now sits at $70.83. Desiring a stronger position in retail stocks this Christmas, I placed a STOP-BUY on and ETF called RTH as mentioned above, so that WMT and RTH reserve $2,222 of my STOCK POSITION.

REGRETS

My original intention of purchasing the DOLLAR STORE STOCKS like FDO, DG, and DLTR was a mistake on my part. These stocks have performed with great strength. Part of learning is admitting when you missed such opportunities. Once a stock has risen so strongly, when you buy it, you can't be sure if it has already peaked; so instead of chasing stocks, you need to capture them when they are oversold. FDO, DG, and DLTR still have some momentum, but my gut feeling is that it is too late to join the party.

BUYING OPPORTUNITIES

So I am looking for BUYING OPPORTUNITIES. CATM (Cardtronics) was beaten down by investors when it missed its target for the 3rd quarter, and missed it only by pennies; still the investors punished the stock for failing them. CATM is still a solid company with great growth both in the U.S. and abroad. Since mid-October CATM has fallen 23.70% and with truly no reason excepting investor disfavor. Now CATM is begining to move side-ways and to consolidate. These are signs to me that a significant buying opportunity is presenting itself.

Remember, you can't time a stock! So if you buy CATM, be prepared for a loss as well as a gain. I will continue to watch the market, but over the next few days I will watch closely CATM. Likely, I will set a STOP-BUY at around $23.00. If CATM is going to restrengthen before the end of the year, it will likely break through $23.00, continuing its climb to much higher. If CATM is to continue a decline, it will likely do that as well and no purchase will be made of CATM with the STOP-BUY. CATM can often move 3% to 5% per day. This means it is quite volatile, but if in an uptrend, you can see strong gains.

As always: Protect your gains with a STOP-SELL; If you buy a stock, determine how much you are willing to lose and sell the STOP-SELL below your purchase price; you are the sole determinate of how much you lose, so chose wisely. Finally, understand that we are in the worst of economic times; never in the history of our economy have the indicators been worse. Conservative economist believe that we are presently in a recession, hidden only by quantitive easing. The QE will continue but a collapsing economic situation can out pace the FEDS will to buy us out. All this debt will turn into INFLATION and we are likely seeing an inflated and bloated stock market .... climbing not because of profits but because of inflation already figured into the market. If you have more specific questions ask me by writing *#drinvest@mail.com and remove the first two characters from the email address.

(note: the above information is for entertainment purposes only and not to be used in anyway as investment advice.