by Dr Invest

Ouch! That smarts! We continue in a downtrend and the problem in a downtrend is that you DON'T know where you will find the bottom. Once the market turns negative, it is hard to get investors on buy back in. Now previously Bernanke could promise a QE-3, but he is already doing the QE-3 and the Twist buy back. As you can see, he really has nothing now to promise. He is doing everything he can do... and if the market goes down it is inspite of Bernanke's best efforts.

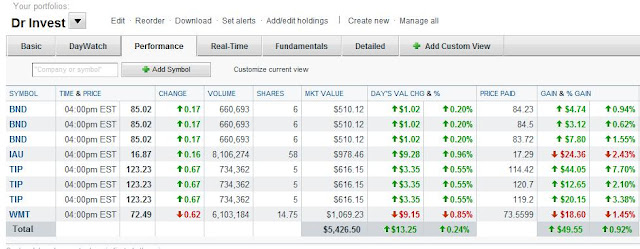

As I sit here and watch the close of the Markets, they are hammered yet another day. Eventhough my losses are low, I'm wishing I was out of the market.

I recently purchase IAU (a gold trust ETF) and saw a decline of over 5%. Presently IAU sits 2.73% below my purchase price of IAU. Gold prices seem to be slowly climbing higher in this chilling market, rising 1.8% today.

I also purchase WMT (Walmart) on election day. WMT would be a great purchase at anytime and should perform well over the Christmas season. WMT lost .85% today, with my total loss at 1.45%. I had hoped that WMT would have moved the other way and I would have sitting on a 1.45% gain. I have WMT set to sell at 5% below the purchase price. (called a STOP-SELL) I have toyed with CATM, setting a STOP-BUY at $25.20 should CATM suddenly rise. CATM continues to decline some, not finding a clear bottom.

Anytime you add new positions, it will make your averages lower on percentage gained because you are adding more money invested to the gains already achieved. So apart from the red figures of recently acquired positions, the green positions have already performed adequately.

BREAKING RULES

Never buy stock in a downtrend. I should have followed the advice, but I had thought that we would have had a new president and a trending market. I was wrong! This is why you have rules. Where any market drops 3% over two days, even the best stocks will also drop in value. The WMT stock could have risen 1.45% or higher, but now I will pay for being impetuous. Down 1.45%, WMT may not begin it's recovery until Monday.

Typically when you have 1% downturn in the stock market or several days of 1% drops, the market will rebound. Likewise, when you have several days that the market turns up 1% each day you will see a RETURN TO THE MEAN. This means market prices drop after strong rises in price.

An EXCEPTION to the "return to the mean" is when entering a BULL MARKET or BEAR MARKET. A BEAR MARKET can continue for weeks, even months when market negativity arises. In this market, however artificial it is, the worst has already happened, so we hum along caught in some kind of weird economic malaise. It can't get much worse because the government is propping up the market, but it certainly can't get much better because the free market is manipulated.

Still, I want to be careful not to buy stocks where there is a LONG-TERM downtrend; and everything seems to point to a "stable market" that is coerced by the FED. Given no major economic impacts by wars or failing central banks, the stocks that have been returning profits are going to a rise in their price.

My expectation is that WMT will rebound on Monday and my other selected stocks could be purchased at that time. DOL.TO and DG are performing the best and both deserve a look.

(Note: the above information is for entertainment purposes only and not to be used as investment advice.)

No comments:

Post a Comment