Today's Market

by Dr Invest

Today a headline read, "Don’t Be Fooled by the Fed: Stimulus Is a Sign of Dysfunction, Not Opportunity". Stimulus is the course we have taken for a number of years because our economy needed to be propped-up. Listen, you don't have to have a doctorate to understand that if you need support beyond yourself, you aren't making it economically. This is the sign-of-the-times that many 40 year-olds are moving their families back-in with their parents because they can't make it any longer financially. Where will the U.S. government move when they can't make it any longer?

I really have no favorites between Republicans and Democrats, both seem equally inadequate in their governance; but if you only knew how the Obama administration is scheming at this moment to raise everyone's taxes and increase the debt ceiling, it would make you pale. Eliminating mortgage interest as a tax deduction is on the table... now who does that affect? Anyone who owns a house. Taxing company provided insurance as a benefit is another idea floated. A bevy of other taxes are being considered and all of them fall not only on the backs of the wealthy, but you too. Discussion of a capital gains tax seem logical, until you discover that the same capital gains would affect everyone with a 401K and an IRA, including the middle class trying to save for retirement. And then there is the consideration of Inheritance Taxes. Yes, the rich would pay their fair share, but many loopholes would have to be plugged. The middle class can't afford the tax lawyers to ferret out the loopholes and would pay the inheritance taxes, while the wealthy pass their wealth on to their families via trusts, limited partnerships, and other tax avoidance instruments.

On of the reasons corporations have moved abroad is to shelter their companies from one of the highest corporate taxes in the world. The U.S. is second, only behind Japan in the corporate tax rate. So why do business in the U.S.? The Progressives or New Socialists are excited about all the taxes they are going to raise so equitable programs can be implemented to pull the poor from their despair. Sadly, the middle class business men will be saddled with the new burdensome taxes to pay for the raised debt cap so the U.S. can continue to do business.

The Realities of the Fiscal Cliff

Boehner has made the first step toward eliminating the fiscal cliff by offering to raise taxes on those making over 1 million annually. Though it is not the deal the President wanted, it opens the way to tax the super rich. 241,000 people make over 1 million annually. This initially seems like a lot of people, but only represents a little less than 1%. Total tax projected to be gained is $3.6 billion.

What is not projected the is will of the wealthy to take advantage of the myriad of tax loopholes before 2013. To understand this, you have to think about the super-wealthy utilizing their profits to find new opportunities for generating new income streams (PROFIT). So they might redirect their profit to build an new company and hiring new employees or taking over another failing company they believe they could make profitable. To keep from paying Obama's new tax realities, the super-wealthy has to place their profits into investments that will shelter their income. Most, though, will likely move their income else where, so they can keep their money working for them.

Walmart is presently looking at purchasing an 80% stake of Turkish retailer Migros Ticaret AS, another rumor is that Walmart was looking at purchasing Hostess Brands Inc. The Chinese believe that Hostess will have a significant market in China and Indo-china, so does Walmart. Corporations and individuals are considering how to shelter their money and as usual, the governments plan to outsmart business men will result in them collecting less taxes and moving more jobs outside the U.S.

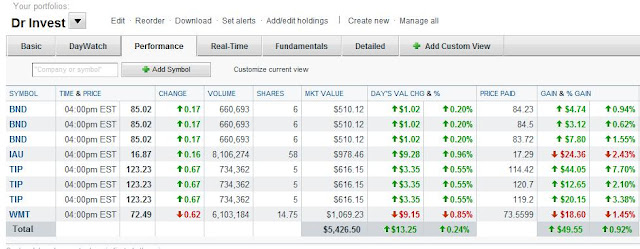

Investment Positions

The fiscal cliff has affected my conservative investment position. Care must be taken at this time to insure the best outcome. As mentioned in a past blog, I suggested placing a stop-sell 1 1/2% to 2% below the closing price of WMT and RTH.

If you didn't follow this advice, you are in the negative right now because both WMT and RTH have fallen. I have set my own personal stop-sell at 5% below the closing price and after falling nearly 4%, I have to ask myself if I want to take a 3% loss or move my stop-sell back to 5% below the purchase price. This is where judgment comes into play. For sure, I will be watching closely how the market responds to Boehner's offer to raise taxes on the rich.

With good news, WMT can quickly recover along with RTH. Even though gains have been recorded by retailers, questions remain on whether the fiscal cliff will dampen spending by the consumers, sending the economy into oblivion. To insure a viable economy, the FED has begun QE-3 with the warning that if the politicians fail to come to a timely agreement even the 40 billion a month may fail to keep markets viable. It is almost certain the politicians will find compromise and the stimulus will spur the economy and a rise in the market valuations. NOTE: MY BLOG on APRIL 22, 2012

In my blog, I show how underlying inflation increases costs of doing business, how businesses raise prices to the consumer, and how increased profits increase valuations. We are seeing a rising S&P, when we should be seeing the collapse of the S&P. No one doubts that if the FED's stimulus stopped, the economy would immediately fall into a recession.

While the safest strategy would be to say out of the stock market, the FED is punishing anyone buy stocks (because they are buying stocks and competing with the investors), and rewarding anyone buying stocks. Now it is doubtful that they can continue this stimulus forever, but 14 economies are presently stimulating their markets. It seems that world banks have agreed to all stimulate their economies together until all their debts are erased. The problem is that if debt is not eliminated by governments, the stimulus would have to continue forever.

For the moment, it seems that central bank stimulus will keep stocks climbing and bonds weak. My guess is that at some point, the economy will weaken and slip into a recession. I would see that happening the first part of 2013, but it could happen at anytime.

For now, I am cautiously watching the fiscal cliff. If the market likes the political outcome, we will see the market revived at least temporarily.

Now all of these are only guesses on my part and the better part of wisdom is guard your investment. I am hoping that you have already sold WMT and RTH, but don't lose more than 5% on these stocks, you can always repurchase in January if the market appears to be improving.

(Note: the above information is for entertainment purposes only and not to be used a investment advice.)